A Quick Dive into Lend Flare’s Innovative Lending Platform

Decentralized Finance or DeFi is a major trend that emerged from blockchain technology and changed the course of modern fintech with its permissionless nature. The potential of cryptocurrency found new pennons on the decentralized platforms and generated an alternative to traditional finance that lacked innovation for decades. DeFi started to take off in the summer of 2020. Compound launched its governance token COMP in May 2020 and the term ‘yield farming’ became a buzzword. Providing liquidity on a lending-borrowing platform like Compound helped the users to earn astonishing yields. AMM (Automated Market Maker) based DEXs started to compete with top tier CEXs in terms of trading volume but all such DEXs faced three challenges: high slippage, high fees, impermanent loss. Curve Finance came up with an innovative solution by building liquidity pools with similar assets like stablecoins. Curve also gave incentive to the users for providing liquidity. The optimized AMM of Curve (0.04% trading fee, low slippage, direct stablecoin to stablecoin swap) caught the attention of the investors and the platform grew exponentially as per TVL (Total Value Locked). DeFi has really travelled a long way now!! The early days’ problem of low liquidity is over. Now, we can see various projects that come up with intuitive and user-friendly platforms offering yield maximizing opportunities and superior capital efficiency. Lend Flare is one such capital efficient platform on the Ethereum blockchain.

Introduction to Lend Flare

Lend Flare is a lending platform that wants to address various problems of the present lending-borrowing DeFi ecosystem. The platform focuses on Curve investors and allows them to borrow against their LPs for a certain time period with a fixed borrow rate. The platform also eliminates any concern of liquidation due to price fluctuations. LFT is the governance token of Lend Flare. It is also given as a reward to the liquidity providers. The tokenomics is inspired by the Curve model. Investors can stake LFT to receive VeLFT. VeLFT is called a vote-managed LFT token with voting right in the governance. Your staking duration determines the number of VeLFT tokens you will get for staking LFT tokens (similar to CRV and veCRV of Curve). VeLFT holders also share 50% of all fees generated through the platform (again like veCRV holders of Curve).

Capital Efficiency

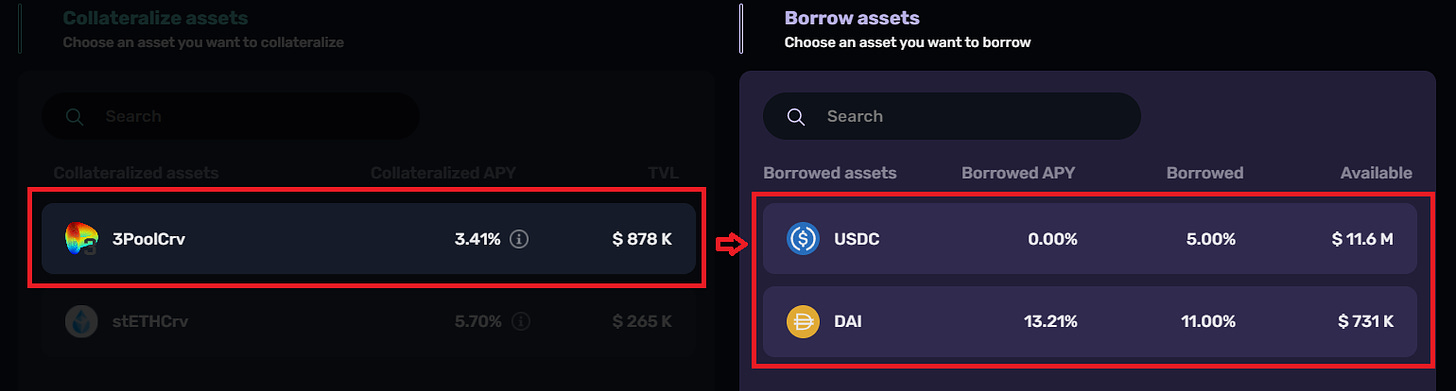

Borrowing: Suppose you want to borrow against your Curve LPs. You need to deposit your LPs (ex: 3PoolCrv, stETHCrv) to Lend Flare. Lend Flare does not keep your LPs idle. It redeposits your Curve LPs into Curve via Convex and uses them as collateral. So, the LPs continue to earn the trading fees from Curve. It is important to note that Lend Flare does not allow the borrowers to borrow the differently pegged tokens i.e. if you hold stETHcrv, you can not borrow DAI or USDC. You need to borrow ETH only in this case. While this sounds complicated, the intuitive UI of Lend Flare makes your job easy. You just need to choose collateralized assets; the platform provides the corresponding borrowing assets. As you only borrow the same pegged tokens in this process, you get a higher collateral ratio in comparison to other platforms. When you select the number of LP tokens that you want to use as collateral and your borrowing time, the UI automatically displays total repayments, borrowing APY and repayment time.

Automatic borrowing asset selection in Lend Flare

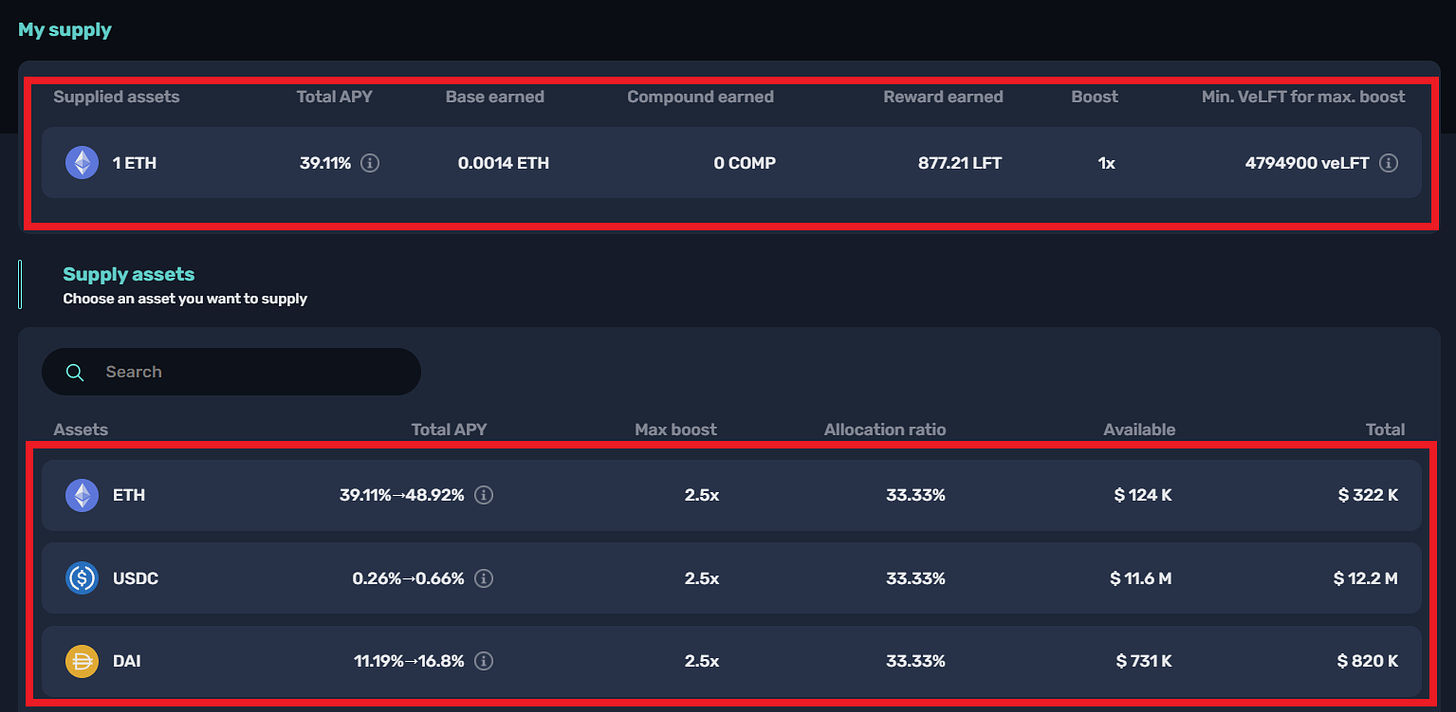

Lending: If you are a lender, you can supply your ETH, DAI, USDC etc. to the platform. Your supply APY and maximum yield boost available is displayed on the screen. Once you supply your asset, it instantly gets deposited into Compound and starts earning interest even if there is no borrower. When the borrowers come, Lend Flare withdraws the fund from Compound and supplies it to the borrowers. The overall process maintains a high collateral ratio and you as a lender enjoy higher supply APY than Compound (APY contribution by Compound interest rate, COMP token, LFT token).

Asset supplying interface in Lend Flare

Win-Win case for suppliers and borrowers

Borrowing happens against collateral here but the important point is that the borrowers borrow the same pegged token with an over collateralized LP for a certain time period. The LPs of the borrowers are not lent out again and the LP values remain stable as factory pools of Curve (user deployed high-risk pools) are not being introduced on the platform at present. The risk of liquidation is extremely insignificant due to all these reasons. When the borrowers repay funds, they immediately get back their LPs. If the borrowers fail to repay funds as per schedule, their LPs get liquidated but they do not miss the LP yield during the loan period. The suppliers also enjoy great safety due to over-collateralization by the borrowers and borrowing of the same pegged token. Overall, the platform provides a win-win solution for both suppliers and borrowers.

Liquidated assets are displayed in the liquidation screen transparently

Lend Flare vs. Curve Gauge

Curve is now the number one DEX as per TVL ($14B+). Many protocols are already battling out to absorb the liquidity of Curve by providing the highest yield to the Curve users. Lend Flare does not want to become a participant in ‘The Curve Wars’. The project aims to combine several protocols to offer an optimized solution to its own users. Lend Flare routes the deposits through Convex Finance, so it can reward Curve liquidity providers with additional DeFi yields. When you deposit your Curve LPs to Lend Flare, you are bound to get more profits than Curve gauge rewards. You also get the loan service from the platform on top of that.

Beta Test Airdrop

Lend Flare is running the Beta test on Ethereum Rinkeby testnet. The objective of the test is to find issues with the platform before launching it on the Ethereum mainnet. The users who participate during the Beta test will be rewarded LFT (1500 randomly selected testers will be rewarded 15150 LFT each). The airdrop will be claimable instantly after IDO. Test the platform here. If you need Rinkey test ETH, obtain it from this faucet. You can test any platform service like IDO, borrowing, supplying liquidity and stake LFT. After testing, retweet beta test tweet along with your etherscan transaction URL and tag two of your friends on Twitter. It will be also wise to tag Lend Flare official Twitter account. Please note that you will be eligible for the airdrop only if you hold any of the following tokens in the Ethereum mainnet: ctoken, CRV, veCRV, CVX and CVXCRV.

Lend Flare has composable smart contracts. It does not want to remain dependent only on Compound and may adopt different other platforms also for generating yield from the supplied assets down the line. Decentralization of such a project is very important to gain investor trust but the path to true decentralization is really not easy. Lend Flare wants to form a DAO soon and desires to be totally community-driven in the coming months. Time lock contracts are also being worked upon. This is a project with a well laid out road map. The mainnet launch is supposed to happen in due course after being cleared by the Certik audit. The protocol’s flexibility can open up various opportunities for it and we may see a thriving ecosystem being built around the main protocol. Only innovators sustain in the rapidly changing DeFi space. Lend Flare’s testnet is working smoothly as of now and the project is gearing up to give nice surprises.

Follow Lend Flare on Twitter to get regular updates and check out their vibrant Discord.