Nomis – Bringing the Next Revolution in DeFi with its Wallet Scoring & Credentials

“Overcollateralization in lending/borrowing means DeFI lending doesn’t expand the money supply (for the same cryptocurrency), which means, without centralization, it will be harder for DeFi to be seen as an alternative to the current fractional reserve banking approach.” - Morgan Stanley

DeFi or decentralized finance is a big buzzword in the crypto world. As per DefiLlama, the TVL (Total Value Locked) in all DeFi protocols stands at USD 41.3 billion now. In November 2021, the TVL reached a peak of USD 180 billion+ while there was a crypto bull run. DeFi has surely enabled a new financial system that doesn’t depend on any third party or centralized entity. Here, smart contracts act as financial robots and fully automate all processes. Lending-borrowing is an important activity in DeFi that supercharges the ecosystem and collateralization is a norm in this space. Transparency, automation and collateralization make DeFi really different from traditional finance. But cryptocurrency is known for its outrageous volatility. The green candles turn red here within a fraction of a second and vice versa. The market volatility led to over-collateralization in DeFi. While over-collateralization reduces risk to the lender or investor, it impacts capital efficiency. It also creates entry barriers for the lending industry. In traditional finance, banks use credit score systems. What if we implement such a system in DeFi? Nomis is a new protocol that is trying to do that.

Over-collateralization is a situation where an asset’s value used as collateral on a loan exceeds the loan value. It enhances the credit rating of the loan. It is a common credit enhancement technique in securitized products like mortgage-backed securities (MBS) and collateralized loan obligations (CLO) in traditional finance. But traditional finance also has non-securitized loan products. Here they use a credit scores to quantify the assessment of a borrower's creditworthiness in general terms or with respect to a particular debt or financial obligation. A credit score, based on credit history, can be assigned to any entity. A high credit score indicates that a borrower is likely to repay the loan in its entirety without any issues and a poor credit score suggests that the borrower might default. DeFi has no credit rating system now and the ecosystem is totally dependent on over-collateralization. If a borrower wants to get a loan from a DeFi platform, he must hold sufficient crypto assets. The core philosophy of DeFi was to make financial products accessible to everyone and the present structure creates hindrances to mass adoption.

Is it really possible to make DeFi loans under-collateralized or even zero-collateralized? All DeFi platforms are trustless and the users are anonymous. There is no assurance that a user with a good credit score won’t default or try to game the system. But credit scores can surely be used for obtaining custom loan terms (collateral factor, APR, liquidation) and minimizing the risk of the lenders. DeFi came as a disruptive financial model and experiments must go on. Nomis has launched a credit scoring system that is unique in nature as it provides scores to a crypto wallet and builds credentials for it. The project has three founders and they have remarkable experience in Web 2 and Web 3. Nomis is a short form of the Greek word Νόμισμα. It means ‘currency’. The open-source wallet qualifier and credit score protocol of Nomis was created after extensive research and brainstorming.

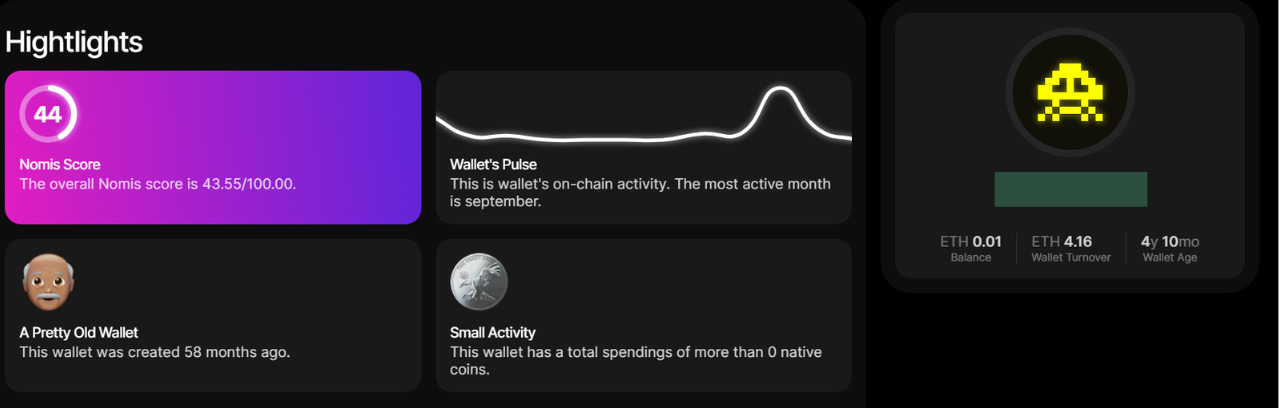

Nomis wants to create a better DeFi ecosystem with more user adoption. The protocol collects on-chain data from L1 and L2 blockchains and transforms it into a credit score. The credit score acts like an on-chain reputation and it is dynamic in nature. The beta interface of Nomis just looks like a Web 2 interface and may be instrumental to onboard mainstream borrowers to DeFi. The project wants to be a one-stop credit solution, so it is multi-chain in nature. Users of Ethereum, Solana, Binance Smart Chain and many other blockchains can get the credit score of their wallets by just typing the wallet addresses. The protocol collects all historical on-chain data and constructs >20 weighted variables. The credit score depends on wallet age, balance, total transactions, DAO activity, NFT holding, trading activity and many other parameters. The scoring is done on a scale of 100. The user also receives some important statistics besides receiving the score. Nomis is backed by big projects like Aave, 1inch, Polygon and Solana. The team is meticulously working to connect the users with many DeFi protocols where the credit score can be used as part of their collateral.

Imagine having a credit score based on all your wallet addresses of different blockchains. It is going to be possible very soon due to Nomis. The long-term vision of the project is to build a multi-chain decentralized ID (dID). The decentralized identity space is still in its infancy. As the world is moving towards Web 3, the need for a decentralized identity seems to be very valid. Only the future will say how Nomis builds it but the credit score definitely has an immediate use case. As the scoring is transparent and algorithm based, the accounting decisions are going to be unbiased. It may be hypothetical to assume that people won’t risk their on-chain reputations but establishing a system for long-term reputations on-chain can pave various paths for DeFi adoption. Keep an eye on Nomis! The project is already doing an active pilot with a top DeFi protocol presently and wants to have 1 million users in the next 6-12 months. Yes, financial fairness is going to be alive on blockchain and crypto may produce something beyond speculation in the near future – unsecured lending!

Follow Nomis on Twitter to get regular updates.

Follow Me

👉 Twitter @paragism_