Crypto.com is a popular cryptocurrency exchange with millions of users. They have really made amazing progress in terms of user adoption and trade volume in recent years. To make cryptocurrency accessible to a wider userbase, they launched many products successfully in the past. They also built open-source, public and permissionless Crypto.org chain leveraging blockchain technology to fulfil their vision. Cronos is an Ethereum Virtual Machine (EVM) compatible sidechain that runs in parallel to Crypto.org chain. The mainnet beta of Cronos went live on November 8, 2021 and it is the first blockchain that is interoperable with both Cosmos and Ethereum ecosystems and thus brings enormous opportunity in the fields of DeFi, NFT and Metaverse. Since the launch of Cronos, many DAPPs were launched on the chain. Fast transactions and low fees of Cronos made it a very attractive choice for the investors and TVL (Total Value Locked) skyrocketed post its launch. Let us go into details of a few interesting and performing DAPPs within the Cronos ecosystem.

VVS Finance

“VVS is designed to be the simplest DeFi platform for users to swap tokens, earn high yields, and most importantly have fun!”

VVS Finance, an automated market maker (AMM) DEX, is the top-performing DeFi project on Cronos. The DEX is Metamask compatible and it is a fork of Uniswap. A liquidity provider earns 2/3 of the trading fees generated from any pair of tokens they have provided liquidity for in proportion to their ownership of the pool. The liquidity pool creation is permissionless. The swap trades are fun here and take place with lightning speed. The trading fee is 0.3% which is shared between the Liquidity Providers and the VVS platform. VVS has adopted a liquidity mining model and you can earn higher APY by providing liquidity to specific pools. Just go to ‘Crystal Farms’ and start harvesting. The ‘Flash LP’ feature helps you to form LP tokens and start farming in one step.

VVS dominates 60% of the DeFi TVL on Cronos as of now. The governance token of VVS Finance is VVS. You can stake VVS and earn more VVS by automatic compounding or manual method in the ‘Glitter Mines’. xVVS is VVS Finance’s yield-bearing governance token and the xVVS vault allows you to get xVVS when you stake VVS. The vault is auto-compounding in nature, so when you want to convert xVVS to VVS, you get more VVS than your initially deposited amount. A portion of the platform revenue is used to buy back VVS and that is distributed proportionally among xVVS holders. VVS also gets a good reason for price appreciation due to this.

‘IGO’ (Initial Gem Offering) is a launchpad platform for brand new tokens. You can buy the listed token at a fixed price. Two types of offerings are there – Gem Fair (Basic Sale) and Gem Warehouse (Unlimited Sale). You need to commit your VVS tokens to take part in the sales here. The more you commit, there is the chance to get a higher allocation. The unspent VVS is returned to you after the sale. The platform also offers a whitelisting option to the projects who want to launch their new tokens. This feature can control bots and whale abuses.

Audit: Fully audited by Slowmist

TVL: $700m

Tectonic

“Tectonic is a cross-chain money market for earning passive yield and accessing instant backed loans.”

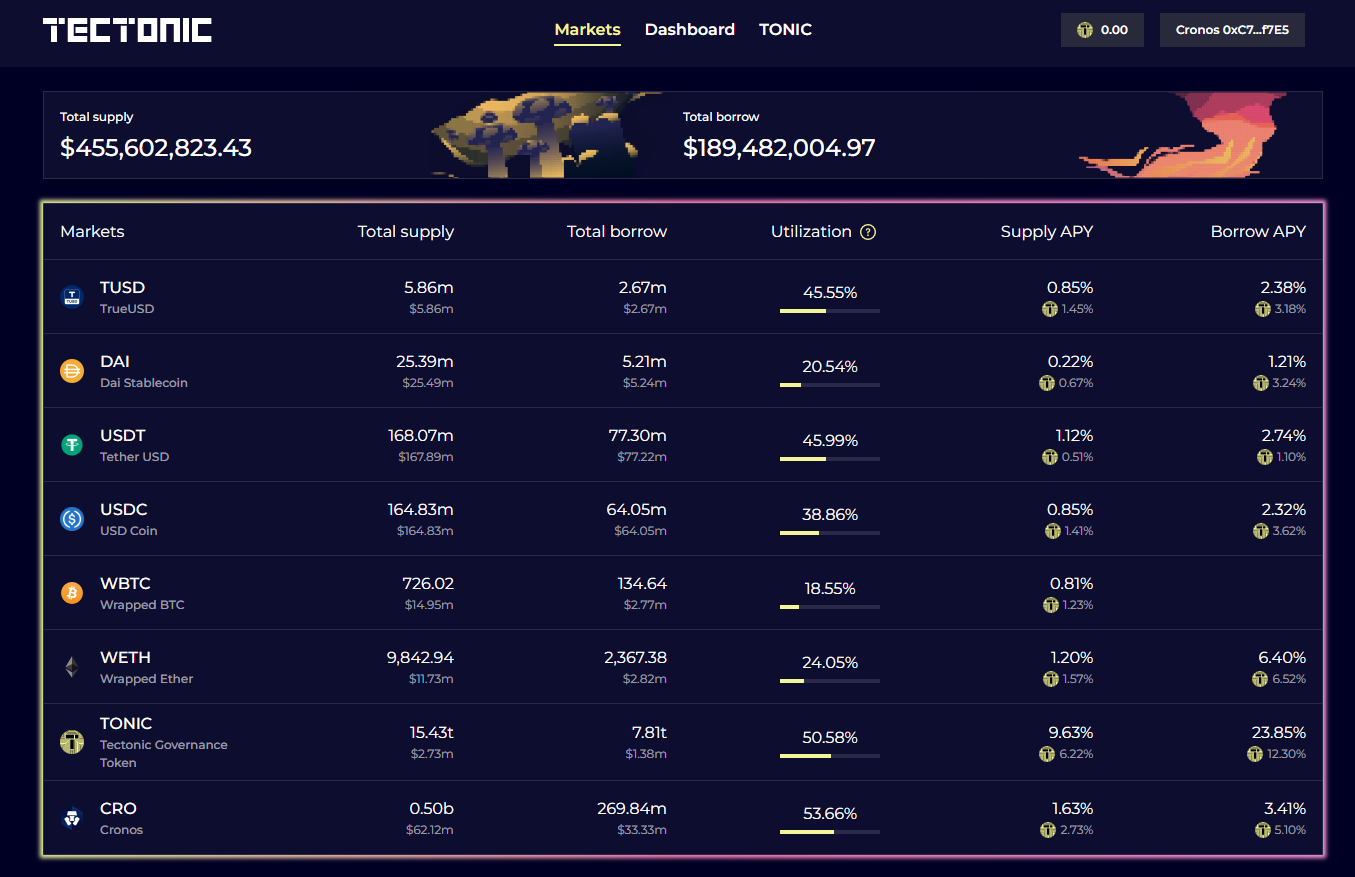

Tectonic is a decentralized money market powered by Cronos. The non-custodial platform allows you to participate as a liquidity supplier or borrower. The platform is a fork of Compound and compatible with Metamask. Your supplied capital earns supply APY as it is borrowed by the borrowers. The yield is attractive due to liquidity mining. When you supply your capital, you receive corresponding tTokens (Ex- tETH when you supply ETH). The tToken can be redeemed for the supplied asset when you want. tToken is yield-bearing due to the deposit APY and its value accrues over time. Using your supplied asset as collateral, you can borrow from Tectonic. Every loan carries a borrowing rate. For each asset, the collateral factor can be different. With an 80% collateral factor, you can borrow 80% of your collateralized value. The borrowed asset liquidation happens as per the market situation. Loan repayment or collateral increase can be done anytime. The collateral factor and supply-borrow rates are decided by the project team as of now but the governance of the protocol will decide that down the line.

Tectonic dominates almost 22% of the DeFi TVL on Cronos now and it is the number one money market on Cronos. The governance token of the platform is TONIC and it has a total supply of 500 trillion. The staking function of TONIC is going to be launched soon. Post-launch of staking, TONIC holders are supposed to earn a share of protocol revenue generated from fees paid by borrowers. An insurance fund is going to be launched soon to protect the stakeholders.

Audit: Fully audited by Slowmist

TVL: $267m

Argo Finance

“The easiest way to stake CRO on Cronos.”

Argo Finance is a liquid staking platform built on Cronos. CRO staking is very popular among the investors of CRO as the staking APY varies from 10-15%. But the problem is that staked CRO remains locked and inaccessible to the stakers. Argo allows you to stake CRO and receive bCRO while earning staking rewards. bCRO can be used across different DeFi platforms (Ex- VVS, MMS, MIMAS etc.) for yield farming and thus generating further yield. This alternative way of CRO staking provides excellent capital efficiency without compromising security. Generally, an investor uses a single validator while staking CRO but when you stake with Argo, your stake is distributed across various validators to reduce the overall risk quotient. The use case of liquid staking derivative can be huge down the line and Argo has really made an intuitive and user-friendly interface. The platform is Metamask Compatible.

Argo is a very new platform, The TVL is not high and please try to judge the platform properly before going ahead. The governance token of the platform is ARGO. The platform wants to embrace complete decentralization in future and then ARGO token will be used to vote for all governance decisions including the determination of the proportion of CRO being delegated to respective validators. A slashing insurance fund is also on their roadmap. You can also stake ARGO to receive xARGO. xARGO can be pledged into the revenue pool to earn your share of protocol fees. 50% of all protocol fees are distributed to xARGO pledgers now. Sounds cool!

Audit: Audited by Certik (SkyNet Trust Score is not available)

TVL: $4.3m

Cronos ecosystem looks veritably vibrant. You can transfer assets from Crypto.com app or website to the Cronos chain very easily using this guide. The Cronos Bridge is also working fine and it can be used to transfer assets to and from Cronos (supports Cosmos, Aakash, Terra Classic and Crypto.org as of now) in a decentralized manner. Ethereum- Cronos bridge is coming soon and a lot of fresh liquidity can be expected on Cronos that will bootstrap the ecosystem. Wanna add Cronos to Metamask? Do it in one step using this Chainlist link. Due to EVM compatibility, many Ethereum developers have started to deploy their DAPPs on Cronos. There is no doubt that Cronos offer high promise. The userbase is almost growing at 20% per month. Get ready to witness more interesting projects on Cronos!

Follow Cronos Twitter and join their Discord to get regular updates. DYOR before investing your hard-earned money.

Cronos looks really interesting.